Sotheby's CEO Steps Down Amidst Rumors of Board Unrest

- Sotehby's Headquarters at 1334 York Avenue, NYC. Photo by Angel Franco, courtesy of The New York Times

Sotheby’s announced last week (November 20, 2014) that its CEO, William F. Ruprecht, is stepping down from the company’s leadership in a mutual agreement with the administrative board. The announcement came amidst rumors that Ruprecht was to be removed from his position due to significant decreases in the auction house’s shares, which dropped nearly 20% over this past year.

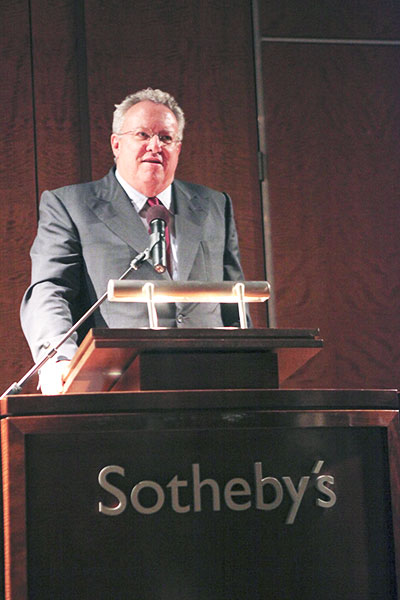

- William F. Ruprecht, the recently ousted CEO of Sotheby's. Photo by Sean Mader, courtesy of Artnet

William F. Ruprecht, a thirty-year veteran of the company, has worked across various departments within Sotheby’s since joining in 1980. From 1986 to 1994 he served as the Director of Marketing before being promoted to Executive Vice President and Managing Director of Sotheby’s North and South America, a position in which he served until 2000. Following that, he was appointed president and CEO of the company. Most recently, Ruprecht was elected chairman of the board in 2012.

A committee, headed by Lead Independent Director Domenico De Sole and supported by headhunting firm Spencer Stuart, has been assembled to find a new CEO. It has been announced that Ruprecht will stay on until Sotheby’s can find a suitable replacement. De Sole said of the search, “The Board is focused on ensuring a smooth transition that will facilitate Sotheby’s continued success . . . We are moving with a sense of urgency but we will take the time we need to find the right leader for Sotheby’s at this critical juncture in its continued evolution.”

- Daniel S. Loeb, board member of Sotheby's. Photo by Michael Nagel, courtesy of The New York Times

Ruprecht’s resignation ends a long-running feud between the former CEO and Sotheby’s board member Daniel Loeb of Third Point Management, which is a large shareholder of the auction house. Antoine Gara, of Forbes, reported that Loeb and Ruprecht “battled” over the company’s strategy, with Loeb “[calling] for [Ruprecht] to return more of Sotheby’s profits to shareholders, while also improving the company’s efficiency and operating performance.” As a board member, Loeb pushed for aggressive growth strategies including actively courting high-end markets in China and partnering with eBay, a move intended to increase the company’s presence in the mid-level art market. Of the eBay partnership, Loeb said that Ruprecht had previously, “[shunned] the lower value lots that [their] top competitor has effectively captured by leveraging new technologies.”

Ruprecht is more optimistic of his legacy at Sotheby’s saying, “The last few years have been the most successful in the Company’s history. I am comfortable and confident saying Sotheby’s is well positioned for the next chapter of its success, and I will do all I can to contribute to a smooth leadership transition.” De Sole also lauded Ruprecht for his contributions to the auction house, saying, “We are deeply grateful to Bill Ruprecht for his long and exemplary service to Sotheby’s and how he has successfully guided the Company through serious challenges into an era of significant growth and development . . . My fellow directors and I salute Bill’s unwavering dedication and the many significant contributions he has made to Sotheby’s for more than three decades.”